[Avoid] Videos

???? Follow me to stay updated on what’s going on in the credit/financial world!

King Credit Services is a 5 star rated credit repair company focusing on education and efficiency! We treat all clients with respect and is always transparent about results!

Want us to dispute FOR YOU?? Schedule a call HERE ???????? www.joinkingcredit.com

Don’t trust credit repair and would rather do it YOURSELF??

Grab our DIY Bundle https://www.kingcreditbundle.com/

????WANT TO MAKE MONEY WITH US ????

EARN $50/lead WITH OUR AFFILIATE PROGRAM ???????? https://www.kingcreditaffiliate.com/

Get your credit report for $1 ????????: https://www.identityiq.com/help-you-to-save-money.aspx?offercode=4311469O

Do you have LESS than 5 open accounts? Let’s Fix that!!

Here are 5 EASY APPROVAL accounts: https://docs.google.com/document/d/1GAXfam_qWTmMGjfhnQV6R9JKC2aQB_9nGiThwsYgZxI/edit?usp=sharing

Follow us on social media:

Instagram – Instagram.com/kingcreditservices

Tiktok – TikTok.com/@kingcreditservices

Meta – Facebook.com/kingcreditservices

Website: www.kingcreditservices.com

Video Title: Remove Late Payments Fast! How to Dispute & Avoid Debt Consolidation Traps

Join Our Community:

Don’t forget to like ????, comment ?????, and subscribe ???? to stay updated with our latest videos. Share this video with anyone who might find it helpful! ????

Thanks for watching, and here’s to taking charge of your credit health by effectively handling late payments! ????????

#LatePayments #GoodwillLetter #CreditRepair #FinancialHealth #ManageDebt #ImproveCredit #CreditScore #PersonalFinance #FinancialLiteracy #DebtManagement #CreditCounseling #CreditTips #PreventLatePayments #CreditEducation #FinanceTips #Budgeting #ConsumerFinance #CreditStrategies #FinancialPlanning #CreditAwareness #CreditManagement #CreditSolutions #CreditAdvice #CreditImprovement #CreditReport #FinancialWellness

Bill shock post December festive season and January you see the credit card bill ????????????.

Here’s the tip how to resolve this issue.

Debt consolidation!

• The video discusses how people tend to overspend on their credit cards during the festive season, leading to credit card bill shock.

• It highlights the convenience of tap and go payments but warns about the lack of awareness of spending.

• The video suggests two solutions: doing a credit card transfer to a no-interest account and closing the current credit card, or consolidating debt into a home loan facility to improve cash flow.

• It advises creating a separate savings account to budget for future expenses during December.

• The video emphasizes the importance of avoiding financial mess and planning ahead to prevent credit card bill shock.

0:00 Intro

0.01 We do get a little bit carried away and

statistically speaking in December people

00:13 tend to spend 25% more on their credit cards it’s

because of the festive season you get carried awayit’s a little bit silly and the big one is the tap and go it gets you all the time. If you’re not used to having cash in your wallet, I think cash hurts more emotionally to hand over and you can physically see what is being left and back in my time I’m a little bit older um I used to

0:36 find that handing over $100 bill or $50 or $20 or whatever your note currency was at the time it used to be a little bit more physical HEY I’m letting go of this money and you could see it whereas now you tap and goes it’s on your mobile phones on the credit card tap tap tap

0:52.get a little bit carried away and you forget to check and by the time you do check it’s a little bit like holy **** whatever what’s happened so if this is a situation that you’re in you can either a try to do a credit card transfer into something that is no interest for a

01:15 certain period of time clear off the credit card. Start off fresh make sure that you close down your current credit card and you’re not getting two credit cards recycling because then it it’ll you know basically will have a financial mess and it’s a little bit harder to get out of.

01:33 that one the other thing that you could do is if you’ve got a home loan facility try and debt consolidate that all into the one facility so it just improves your cash flow and then for next time around make sure that you put a little bit of savings um in a separate account so then when December does come along you’ve got a clear budget of what you’re actually wanting to spend.

01:58 It doesn’t catch you out again January 2025 with another what we call it Bill shock round two so hopefully you found that useful if you got any questions feel free to give me a call happy to have a chat Laura Moya

02:16 Local Mortgage Broker Melbourne

Laura Moya Local Mortgage Broker based in Melbourne covers the issue head on.

#Localmortgagebroker

#localmortgagebrokermelbourne

#RefinanceCreditcardaustralia

#debtconsolidation

#debtconsolidationloan

#billshock

#costoflivingcrisisaustralia

#howtogetoutofdebt

#mortgagebrokertip

#mortgagebrokertricksanstips

#melbourne

#refinance

#refinancing

#Debtconsolidationtips

subscribe to our channel for more mortgage tips and tricks in easy to follow ways.

https://youtube.com/@LauraMoyaLocalMortgageBroker

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it. Our typical fee for arranging a mortgage is £500 on successful mortgage offer.

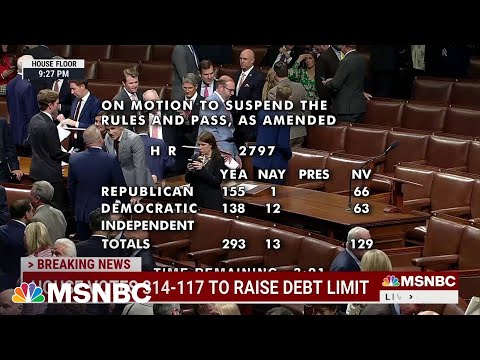

Jen Psaki, former White House press secretary, and Peter Baker, chief White House correspondent for The New York Times, talk with Alex Wagner about what was accomplished by both parties as the House passes the debt ceiling bill, sending it to the Senate, and what President Biden might do to avoid having to deal with a Republican debt ceiling stunt in a potential second term.

» Subscribe to MSNBC: http://on.msnbc.com/SubscribeTomsnbc

Follow MSNBC Show Blogs

MaddowBlog: https://www.msnbc.com/maddowblog

ReidOut Blog: https://www.msnbc.com/reidoutblog

MSNBC delivers breaking news, in-depth analysis of politics headlines, as well as commentary and informed perspectives. Find video clips and segments from The Rachel Maddow Show, Morning Joe, The Beat with Ari Melber, Deadline: White House, The ReidOut, All In, Last Word, 11th Hour, and Alex Wagner who brings her breadth of reporting experience to MSNBC primetime. Watch “Alex Wagner Tonight” Tuesday through Friday at 9pm Eastern.

Connect with MSNBC Online

Visit msnbc.com: http://on.msnbc.com/Readmsnbc

Subscribe to the MSNBC Daily Newsletter: MSNBC.com/NewslettersYouTube

Find MSNBC on Facebook: http://on.msnbc.com/Likemsnbc

Follow MSNBC on Twitter: http://on.msnbc.com/Followmsnbc

Follow MSNBC on Instagram: http://on.msnbc.com/Instamsnbc

#msnbc #debtceiling #republicans

Debt consolidation loans can help reduce your outgoings and pay off expensive credit.

However, there can be pitfalls and you could pay more over the term.

This debt consolidation loan video will help you understand the main points, benefits and risks. #debtconsolidation #loan #debtconsolidationloan

Please Like, share & subscribe. Get more info at https://www.promisemoney.co.uk/secured-loans/debt-consolidation-loans/

THANKS FOR WATCHING – SEE MORE VALUABLE INFORMATION BELOW

Get updates on new products and ideas below:

BROKERS – Find new and innovative products for your clients.

Register – sign up here – – https://www.promisemoney.co.uk/intermediaries/

Newsletters – get here – – https://zc.vg/AALKp

Linkedin – follow here – – https://www.linkedin.com/in/stevecwalker/

LANDLORDS/ PROPERTY INVESTORS – Products designed specifically for you.

Website – enquire here – – https://www.promisemoney.co.uk/intermediaries/

Newsletters – get here – – https://zc.vg/ZT1ba

Linkedin – follow here – – https://www.linkedin.com/in/stevecwalker/

GENERAL PUBLIC – You can access all our products too.

Website – enquire here – – https://www.promisemoney.co.uk/

Newsletters – get here – – https://zc.vg/XA5gL

Facebook – follow here – – https://www.facebook.com/promisemoney

YOUR BANK MAY HAVE 100’s OF PRODUCTS AND PLANS………

PROMISE MONEY HAS OVER 10,000

1st charge, 2nd charge and even 3rd charge

Term loans, short term bridging, Interest only

Mainstream and specialist / complex products

Residential, BTL, HMO, Commercial, Development & Unsecured Business Loans.

PROMISE MONEY 01902 585020

More details are available at https://www.promisemoney.co.uk/

Representative example

66% of our clients get these rates or less – (This is not a specific example of this product above)

£63,000 over 228 months at an APRC OF 6.1% and an annual interest rate of 5.39% (Fixed for five years – variable thereafter) would be £463.09 per month, total charge for credit is £42,584.52 which includes a £2,690 broker / processing fee. Total repayable £105,584.52.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

Tags: mortgages, mortgage rates, help to buy, mortgage interest rates, mortgage broker, buy to let mortgage, best mortgage rates, remortgage, equity release, interest only mortgage, 95 mortgages, buy to let, first time buyer mortgage, first time buyers, bad credit mortgage, 5 mortgages, 5 deposit mortgage, second charge mortgage, second mortgage, 2nd mortgage, independent mortgage broker, secured loan, second charge, homeowner loan, homeloan, mortgage, mortgage broker, buy to let, remortgage, bridging, renovation loan, overdraft, Secured loan, Loan broker, Second charge, Homeowner loan, Home loan, Mortgage broker, Poor credit loan, Bad credit loan, Bad credit mortgage, Poor credit mortgage, Mortgage missed payments, Mortgage problem credit, commercial mortgage, commercial mortgage rates, business mortgage, mortgagecalculator, mortgage rates, help to buy, www.promisemoney.co.uk

Holiday spending expert Patty Morrissey offers six tips consumers can follow for a debt-free holiday.

Subscribe to the CBS News Channel HERE: http://youtube.com/cbsnews

Watch CBSN live HERE: http://cbsn.ws/1PlLpZ7

Follow CBS News on Instagram HERE: https://www.instagram.com/cbsnews/

Like CBS News on Facebook HERE: http://facebook.com/cbsnews

Follow CBS News on Twitter HERE: http://twitter.com/cbsnews

Get the latest news and best in original reporting from CBS News delivered to your inbox. Subscribe to newsletters HERE: http://cbsn.ws/1RqHw7T

Get your news on the go! Download CBS News mobile apps HERE: http://cbsn.ws/1Xb1WC8

Get new episodes of shows you love across devices the next day, stream CBSN and local news live, and watch full seasons of CBS fan favorites like Star Trek Discovery anytime, anywhere with CBS All Access. Try it free! http://bit.ly/1OQA29B

—

CBSN is the first digital streaming news network that will allow Internet-connected consumers to watch live, anchored news coverage on their connected TV and other devices. At launch, the network is available 24/7 and makes all of the resources of CBS News available directly on digital platforms with live, anchored coverage 15 hours each weekday. CBSN. Always On.

“Beverly Harzog is a credit warrior. She has gone into the arena, faced the lions, and emerged as one of the foremost experts in the field. I believe that her encyclopedic knowledge of the world of credit cards is unmatched.”

-Adam Levin, Chairman and Cofounder, Credit.com

Credit card expert Beverly Harzog shares how she went from being a credit card disaster to a credit card diva.

When Beverly got out of college, she spent the next 10 years racking up debt on seven credit cards. Credit card limits, she believed, were merely “guidelines,” certainly not anything to be taken seriously. . .especially if she was in dire need of a new pair of shoes. The fact that she was a Cpa at the time adds an ironic twist to the credit quagmire she slowly descended into.

In Confessions of a Credit Junkie, Beverly candidly details her own credit card mishaps and offers easy-to-follow advice, often with a touch of Southern humor, to help others avoid them. In this much-needed book, you’ll learn:

How to use the Credit Card Personality Quiz to choose the right credit cards

The seven ways to use a credit card to rebuild credit

How to get out of debt using a balance transfer credit card-and pay zero interest while doing it

Credit card strategies to save a bundle on groceries, gas, and more

Anyone in debt will benefit from the down-to-earth, practical tips Beverly offers.

The Money Champ’s Guide to Getting a College Degree Debt Free gives you the blueprint on how to attend college without falling into substantial debt. Through sharing his personal story, tips and strategies, podcast interviews, and other resources, Nick Blair shows you the key to success. In this book, you will discover: • The proper way to prepare financially for college • How to find your area of interest before you graduate high school • Strategies on picking the right classes for your future • How to find and get the best and most advantageous scholarships and grants • Creative ways to generate more income while in college • Money and time-management principles and savings strategies • Real-life scenarios to think through and role play

Popular personal finance blogger and money-management expert shows how to overcome financial stress with straightforward advice when debt-reduction programs and budgets fail to help.

?Despite clear danger and explicit warnings, the United States of America?distracted by short-term challenges and its own political dysfunction?is steaming toward its own collision, one with long-term debt.”

Philanthropist, businessman, and former secretary of commerce Peter G. Peterson argues that we can no longer ignore the long-term debt challenges facing our country, because our economic future depends on it. The gross federal debt now exceeds $17 trillion and it is expected to rise rapidly in the decades to come. If the growing gap between projected spending and revenues continues to widen, our federal debt is projected to soar to the highest levels in our nation’s history?more than four times its average over the past forty years. This growing debt and the associated interest costs divert resources away from important public and private investments that are critical to our global competitiveness, threatening our future economy.

Peterson has made it his life’s work to bring awareness to America’s key economic and fiscal challenges. He makes clear that if we continue to ignore America’s long-term debt, we will diminish economic opportunities for future generations, weaken our ability to protect the most vulnerable, and undermine the competitive strength of our businesses globally.

The drama-filled, economically damaging budget battles of the last few years have focused almost entirely on the short term?putting aside the more difficult, but much more important, long-term issues. Peterson offers nonpartisan analysis of our economic challenges and a robust set of options for solving our long-term debt problems. He looks at the impact of aging baby boomers, growing healthcare costs, outdated military spending, a flawed tax code, and our divided political system. And he offers hopeful, durable, and achievable solutions for improving our fiscal outlook through a mix of progrowth reform options that would reduce government spending and increase revenue, and could be phased in gradually in the years to come.

There’s still time to restore the United States as a land of opportunity. Peterson’s diagnosis and recommendations can help us confront our fiscal reality, address our long-term debt, and steer the country safely toward a more secure and dynamic economic future.