[Deal] Videos

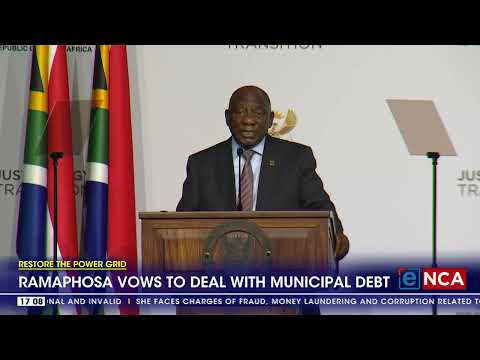

President Cyril Ramaphosa has committed himself to dealing with ballooning municipal debt. Electricity Minister Kgosientsho Ramokgopa says municipalities owe Eskom 78-billion rand. The President says the money is needed to secure the grid. #enca #dstv403

For more news: https://www.enca.com/

Republican lawmakers and White House negotiators are moving closer to a deal to raise the nation’s borrowing limit. Sources familiar with the talks tell CBS News that the deal under discussion would cap federal spending levels for the next two years. Nancy Cordes reports from the White House.

#news #debtceiling #politics

Each weekday morning, “CBS Mornings” co-hosts Gayle King, Tony Dokoupil and Nate Burleson bring you the latest breaking news, smart conversation and in-depth feature reporting. “CBS Mornings” airs weekdays at 7 a.m. on CBS and stream it at 8 a.m. ET on the CBS News app.

Subscribe to “CBS Mornings” on YouTube: https://www.youtube.com/CBSMornings

Watch CBS News: http://cbsn.ws/1PlLpZ7c

Download the CBS News app: http://cbsn.ws/1Xb1WC8

Follow “CBS Mornings” on Instagram: https://bit.ly/3A13OqA

Like “CBS Mornings” on Facebook: https://bit.ly/3tpOx00

Follow “CBS Mornings” on Twitter: https://bit.ly/38QQp8B

Subscribe to our newsletter: http://cbsn.ws/1RqHw7T?

Try Paramount+ free: https://bit.ly/2OiW1kZ

For video licensing inquiries, contact: licensing@veritone.com

How to deal with the emotional stress of being under debt review | Debt counseling in South Africa

We are bookkeepers in Pretoria and we service clients across South Africa. Our focus is on preparing documents for business funding, tax preparation, and clean up of your business books, as well as monthly bookkeeping services.

To find out more about our bookkeeping services go to: https://profitandbooks.com/

I am Olivia Sambo, co-owner of Profits and Bookkeeping Services and Online Marketing Services. I am a qualified Bookkeeper who has studied with the Institute of Certified Bookkeepers, the ICB. My goal with every client is to understand their vision for their company so we can implement systems that will improve their cash flow, money management, and profitability.

Most clients come to me when they want their documents to be prepared for tax or when they want to apply for funding from a bank or a financial institution. In most cases, they’ve never had a bookkeeper, and all those years of neglecting their books take time and knowledge to untangle.

What skills do you need to be a bookkeeper?

You need to be someone who’s meticulous and pays attention to details because one digit in the wrong place can lead to the books not balancing. You need to be patient and focused to capture the information accurately because sometimes these numbers can be very overwhelming. You must be honest and have integrity because you deal with very confidential information about clients. You must honour the trust that your clients put in by safeguarding the trust and protecting their privacy.

As a bookkeeper, you must understand the accounting system and make sense of the debit and credit entries. You must also have a basic understanding of Mathematics.

What does a bookkeeper do?

Bookkeepers capture information from the source documents that a client provides. Different types of accounts then get created to reflect the assets, liabilities, income, expenses, and equity accounts. These accounts will be a reflection of the income and expenses of the business and will be used to prepare management reports for the management of the business or a financial institution.

What are source documents?

Source documents are any proof of the transactions that take place within a business. It could be invoices, receipts, debit notes, credit notes, till slips, etc. It shows the source of the transactions that are reflected on the bank statement. Source documents are also called supporting documents

Why are the source documents so important?

When you look at your bank statements you will mostly see POS purchases when you swipe your debit or credit card to buy goods. When a client pays you it will only show as a deposit.

The source documents will show exactly whether you’ve spent money on fuel, stationery, or printing. It will enable the bookkeeper to put the entry under the right category.

Why do you need a bookkeeper when you apply for funding?

The bank wants to see how well you manage your money, what is your income, what is are your expenses, what part of your business makes the most money, etc. Your bookkeeper will be able to prepare this information when you provide her with your bank statements and source documents. The banks and financial institutions want documents that will give them an overview of your business all in one place. A bookkeeper will know how to use your monthly bank statements to create the right accounts that are needed to prepare the financial reports for the bank. If you don’t have these reports prepared the bank will advise you to find a bookkeeper who can do that for you. If you are a business owner or self-employed the bank will not consider your application for funding without these reports because that is the proof of income they need to see if you qualify for the business loan.

For more information about we what we offer go to:

https://za.pinterest.com/profitsandbooks

https://www.linkedin.com/in/profitsandbooksbookkeepingservices

https://www.facebook.com/profitsandbooksbookkeeping/

https://twitter.com/profitsandbooks

https://anchor.fm/olivia-sambo

https://podcasts.apple.com/us/podcast/rose-tinted-glasses-with-olivia-sambo/id1522074736?uo=4

https://open.spotify.com/show/7JABIEU33PfULlam27sOyY

https://podcasts.google.com/feed/aHR0cHM6Ly9hbmNob3IuZm0vcy8xOTUxMTA1OC9wb2RjYXN0L3Jzcw==

https://profitsandbooks.blogspot.com/

https://news.google.com/publications/CAAqBwgKMObWnAsw8uC0Aw?hl=en-ZA&gl=ZA&ceid=ZA%3Aen

https://g.page/r/CQEpG0p7PPdiEAE

To find out more about funding go to:

https//:www.Nedbank.co.za

https//:www.FNB.co.za

https//:www.Capitec.co.za

https//:www.Absa.co.za

https//:www.Standardbank.co.za

https//:www.Tymebank.co.za

https//:www.Bankzero.co.za

https//:www.Dti.co.za

https//:www.Nyda.co.za

https//:www.Investec.co.za

https//:www.Bidvest.co.za

https//:www.Sab.co.za

https//:www.Discoverybank.co.za

If you want to become a bookkeeper in South Africa go to:

www.icb.org.za

If it’s all about the post-pandemic recovery and if deficits no longer matter… then what about Africa? France welcoming leaders for a summit devoted to finance and relieving the debt owed by a continent that felt the full brunt of a world economy under lockdown. The age-old question more acute than ever: how to be like the US and Europe and earmark huge sums for health care, schools, green energy and infrastructure… instead of using the money to pay interest on old debts?

Subscribe to France 24 now:

http://f24.my/youtubeEN

FRANCE 24 live news stream: all the latest news 24/7

http://f24.my/YTliveEN

Visit our website:

http://www.france24.com

Subscribe to our YouTube channel:

http://f24.my/youtubeEN

Like us on Facebook:

https://www.facebook.com/FRANCE24.English

Follow us on Twitter:

https://twitter.com/France24_en

How Do I Deal with Time-Sensitive Debts?

Say goodbye to debt forever. Start Ramsey+ for free: https://bit.ly/35ufR1q

Visit the Dave Ramsey store today for resources to help you take control of your money! https://goo.gl/gEv6Tj

Get life-changing financial advice anytime, anywhere. Subscribe today: https://www.youtube.com/c/TheDaveRamseyShow?sub_confirmation=1

Ramsey Network (Subscribe Now!)

• The Dave Ramsey Show (Highlights): https://www.youtube.com/c/TheDaveRamseyShow?sub_confirmation=1

• The Dave Ramsey Show (Live): https://www.youtube.com/thedaveramseyshowlive?sub_confirmation=1

• The Chris Hogan Show: https://www.youtube.com/user/ChrisHogan360?sub_confirmation=1

• The Rachel Cruze Show: https://www.youtube.com/user/RachelCruze?sub_confirmation=1

• The Ken Coleman Show: https://www.youtube.com/c/TheKenColemanShow?sub_confirmation=1

• Christy Wright: https://www.youtube.com/c/ChristyWright?sub_confirmation=1

• Anthony ONeal: https://www.youtube.com/user/aonealministries?sub_confirmation=1

• John Delony: https://www.youtube.com/c/JohnDelony?sub_confirmation=1

• EntreLeadership: https://www.youtube.com/c/entreleadership?sub_confirmation=1

Welcome to The Dave Ramsey Show like you’ve never seen it before. On this channel, you will find all of the greatest highlights from The Dave Ramsey Show! The show also live streams on YouTube M-F 2-5pm ET! Watch Dave live in studio every day and see behind-the-scenes action from Dave’s producers. Watch video profiles of debt-free callers and see them call in live from Ramsey Solutions. During breaks, you’ll see exclusive content from our Ramsey Personalities —as well as all kinds of other video pieces that we’ll unveil every day.

The Dave Ramsey Show channel will change the way you experience one of the most popular radio shows in the country!

Student loan debt forces millions of Americans to put off major life milestones like buying a home or having a child. Refinancing your loans only works if you have a great credit score and steady income. We put together six things you can do to deal with your debt and move on with life, including crowdfunding, joining a service organization, and voting for candidates for plans for student debt.

MORE PERSONAL FINANCE CONTENT:

Here’s Your Year-Long Guide To Financial Stability

https://www.youtube.com/watch?v=eoOQLA3TDtc

Easy Steps To Get Out Of Debt, According To A Certified Financial Planner

https://www.youtube.com/watch?v=CHiOBzqcMV8

How This Couple Avoids Fighting About Money

https://www.youtube.com/watch?v=_zvyMusgpyQ

——————————————————

#Money #PersonalFinance #BusinessInsider

Business Insider tells you all you need to know about business, finance, tech, retail, and more.

Visit us at: https://www.businessinsider.com

Subscribe: https://www.youtube.com/user/businessinsider

BI on Facebook: https://read.bi/2xOcEcj

BI on Instagram: https://read.bi/2Q2D29T

BI on Twitter: https://read.bi/2xCnzGF

BI on Amazon Prime: http://read.bi/PrimeVideo

————————————————–

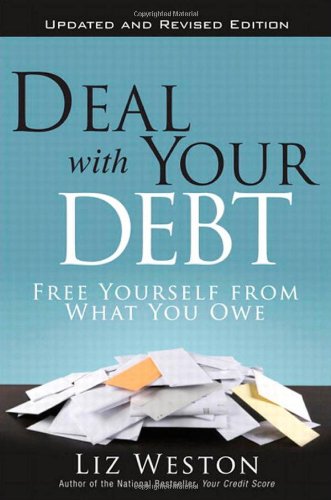

6 Creative Strategies To Deal With Student Loan Debt

Struggling with debt? Get realistic help that’s actually useful, from Liz Weston, one of the most popular and respected personal finance experts! Today, people struggling with debt have far fewer options: lenders are stingier, which makes it harder to avert disaster, or to recover from setbacks like foreclosure, short sales, or bankruptcy. (Meanwhile, people with good credit have more options than ever, including some of the lowest interest rates in decades.) You need an up-to-date guide that can help you assess options, find help, discover opportunities, and take action that works. Liz Weston’s Deal with Your Debt, Updated and Revised Edition is that guide. Weston reveals why most “conventional wisdom” about debt is just dead wrong. For most people, it’s simply impractical to pay off every dime of debt, and live forever debt free. In fact, doing that can leave you a lot poorer in the long run. You’re more likely to give up, or pay off the wrong debts. You could leave yourself too little flexibility to survive a financial crisis. You could neglect saving for retirement. You might even wind up in bankruptcy — just what you’re trying to avoid! For most people, it’s smarter to control and manage debt effectively. In this extensively updated guide, Weston shows how to do that. You’ll learn which debts can actually help build wealth over time, and which are simply toxic. You’ll find up-to-date, real-world strategies for assessing and paying off debt, money-saving insights on which debts to tackle first, and crucial information about everything from debt consolidation loans to credit scores and credit counseling. Weston offers practical guidelines for assessing how much debt is safe — and compassionate, realistic guidance if you’ve gone beyond the safety zone. If you’ve ever worried about debt, you’ll find the new edition of Deal with Your Debt absolutely indispensable.