[Fast] Videos

Top 5 Debt Consolidation Companies That Help You Mop Your Debt Away Fast and Cheap. Which is the best debt consolidation company that can help you trim that fat debt of yours? Watch.

?LEARN MORE. CHECK OUT 100+ FREE TUTORIALS IN THE #SwittyKiwiDebtMasterClass.

?GET HELP ON THIS VIDEO’S TOPIC. READ ABOUT OUR FREE DEBT CLINIC BELOW.?

?CHECK OUT OUR POPULAR YOUTUBE PLAYLISTS:

??Get Loans, Credit Cards & Mortgages http://bit.ly/SwittyKiwiCredit

??File Taxes Properly http://bit.ly/SwittyKiwiTaxes

??Invest, Thrive & Retire http://bit.ly/SwittyKiwiInvesting

??Make Money Online http://bit.ly/SwittyKiwiMakeMoneyOnline

??Run Your Business Well http://bit.ly/SwittyKiwiRunYourBusiness

??DROP US A LIKE AND SUBSCRIBE TO OUR CHANNEL. WE REALLY APPRECIATE YOU.?

??WATCH OTHER VIDEOS RELATED TO THE ONE YOU JUST SAW:

1. Top 5 Fair Credit Business Loans That Won’t Screw You Over https://youtu.be/OwYJLGkP9cQ

2. How to Get a Business Loan With Bad Credit and No Collateral https://youtu.be/ZALff5c-zxo

3. Top 5 Startup Business Loans With No Credit Check 2021 https://youtu.be/1LMYOVBo73g

4. Top 10 Startup Credit Cards Without Personal Guarantee https://youtu.be/a8bBiVH8PBE

5. Top 10 Business Loans for Bad Credit 2021 https://youtu.be/fQqe5YSkUjA

?????????????????????????????

ENJOYED THE VIDEO? Drop us a LIKE and SUBSCRIBE to our channel.

(Psst… we really ?? LIKES, and we also APPRECIATE our VIEWERS very, very, very much ?.)

?????????????????????????????

?GOT QUESTIONS ON THIS TOPIC OR OTHER DEBT-RELATED MATTERS? WE’VE GOT ALL THE ANSWERS YOU NEED. WE CAN HELP YOU TODAY.

?DROP YOUR COMMENT BELOW – AND WE’LL ANSWER WITHIN 24 HOURS. Given how “crazy” 2020 was (Covid-19, economic crisis, unemployment, etc.), we’ve set up a FREE DEBT MANAGEMENT CLINIC to help millions of Americans and businesses manage their debt and understand what it takes to quickly pay down debt and increase their credit scores.

?OFFER VALID YEAR-LONG. OUR DEBT EXPERTS ARE READY TO HELP. 17 CPAs, 7 personal-finance specialists, 28 certified financial planners, 3 mortgage underwriters and 10 debt settlement lawyers will answer all relevant questions in a timely manner, including those related to:

– CREDIT CARDS FOR INDIVIDUALS AND BUSINESSES

– PERSONAL LOANS AND LINES OF CREDIT

– BUSINESS LOANS AND LINES OF CREDIT

– MORTGAGES

– SUSTAINABLE CREDIT SCORE IMPROVEMENT TECHNIQUES

??????????????????????????????

??????????? AWESOME TO HAVE YOU! ??????????? ??????????????????????????????

THANKS FOR THE VISIT. MAKE YOURSELF COMFORTABLE.

?????????????????????????????

?WANT TO RAISE YOUR IQ? Subscribe.

?HAVE AN IDEA? Comment below.

?LOVE THE VIDEO? Like and share it.

?WANT TO TALK? Email us.

?????????????????????????????

WANT TO LEARN MORE? VISIT US. ???

?FACEBOOK – https://www.facebook.com/swittykiwi/

?INSTAGRAM – https://www.instagram.com/sweetikiwi7

?YOUTUBE – https://www.youtube.com/swittykiwi

?PINTEREST – https://www.pinterest.com/swittyk

?TWITTER – https://www.twitter.com/SwittyKiwi

?????????????????????????????

COPYRIGHT-FREE MATERIAL???

STOCK IMAGES: DREAMSTIME, iSTOCK and GETTY IMAGES

? VIDEO MUSIC FROM YOUTUBE AUDIO LIBRARY?

?? INTRO: “AVERAGE”BY PATRICK PATRIKIOS

?? BACKGROUND: “TIMPANI BEAT” BY NANA KWABENA

#SwittyKiwiReviews#PersonalLoans#SwittyKiwiDebtMasterClass

According to my Credit Score, I owe around $12,723, and I plan on paying off in less than 6 months, although I could pay it off in one payment.

And that’s why in this video im going to give you guys my plan to how I owe 12,723, and I pay 0 interest and the different ways to get rid of this debt without paying interest.

Im going to answer these questions.

The fastest way to pay it off?

How to pay no interest?

And if you should just default?

How to pay off credit card debt fast | Less than 6 Months

One Rule: Once you’re done, stay out of credit card debt. Use the card with rewards and points and pay them off in full, and that way, you win, and the credit card company doesn’t make 30% by charging you interest.

1. Audit: this how we know how much we owe and to who and at what price.

– List Credit Cards, Interest rate and amount

– ( call in your credit if you don’t know the APR or go to the App)

Example:

Apple rewards Card: 27.49% and I owe $5,014.53 (it’s 0% because of promo)

Discover it Card: 16% and I owe $310 (it’s 0% because of promo also)

Chase Unlimited Card: 26.49% and I owe $1999.62 ( 0% because of promo)

What to Do and which one to pay Off and How? Avalanche Method saves us Money

Step 1: Organize the Card in order of high APR

Step 2: Pay More money towards that card and the minimum on the others

Step 3: repeat

Tip: I pay 560 on average a week towards my cards; you can start 100 bucks or an extra 60; the key is to step by step lower the balance.

2. How to Avoid Paying Interest

Tip: transfer the balance to another card with a promotional Period

How: its Call a balance transfer

Story:

– I needed cash, so I would take cash advances and do deals with them

– Now once I had to pay interest, I would transfer the balance to a card that gave me 12-21 months to pay it off interest-free

– Why? You have to pay 3% to transfer the balance, but that’s a lot better than 27%

Instructions:

– Get a balance transfer card

– Transfer the balance

– Pay your cards in full before the time runs out

Video on the best Cards: https://www.youtube.com/watch?v=X3kNqHWezKU

3. Should you Default ( I’ll make an entire video on this later on)

Story: I remember I got my first credit card, and I spent 3k and maxed it out, and then 1-2 months later, I lost my job.

– I thought about, and some people recommended I stop paying but just like you I came to videos and books to find solutions

– In the end, if I would have stopped paying I would have been financially screwed over

– Plus theirs a lot more benefits to solving problems you get yourself into, than defaulting and banks know that and respect that.

* PRO TIP*

INFORMATION IS EVERYTHING

?Merch?

https://teespring.com/stores/tommybryson

?2 FREE AUDIOBOOKS?

https://amzn.to/2Enayo8¬¬¬

?ACORN FREE $5?

Link: https://acorns.com/invite/38EYSU

?FREE KINDLE UNLIMITED? (traditional reading)

Link: https://amzn.to/2VGbxt9

????DISCORD PRIVATE GROUP???? ( Limited – Comment if Full)

https://discord.gg/JVsXZ6h

My Camera Gear: https://kit.com/tommybryson/video-recording-gear

? Help Us Reach 50,000 Subscribers: https://goo.gl/0wvm6w

Social Media~

Facebook: https://www.facebook.com/tommybryson.yt

Twitter: https://twitter.com/TommyBrysonVlog

Instagram: https://www.instagram.com/tommybryson

Snapchat: tommy28fly

These are my 20 tips on how to get out of debt and paid off over $80,000 of debt and how to make money online from home!

Link to National Debt Relief: https://www.nationaldebtrelief.com/myka

Thanks National Debt Relief for sponsoring this video

How to get out of debt is a process that requires a plan and discipline to earn money and make money to tackle each piece. My husband and I have worked really hard to make money online, doing side jobs that are unique, work from home with several business ventures all to pay off our student loans, making money and get out of debt.

Please SUBSCRIBE! We are so close to 250k-http://goo.gl/QSPSi6

My Videos on Selling On Ebay, making money online, how to make money online 2017:

EBAY: HOW TO MAKE THOUSANDS ON EBAY EACH MONTH! – https://goo.gl/ziuK9N

EBAY SELLING: HOW TO LIST AND PRICE LIKE A PRO! MAKE MONEY FAST! – https://goo.gl/WYjFkc

HOW TO MAKE MONEY ONLINE 2017 || 10 WAYS TO WORK FROM HOME – https://youtu.be/RMjT7RHn1L8

?VIDEOS TO GET TO KNOW ME BETTER:

Draw My Life: https://goo.gl/e7cDNH

Our Big Announcement: https://goo.gl/NY2GH9

Live Birth of My Son: https://goo.gl/aarYyl

Why We are Adopting: https://goo.gl/Kv4yl4

? LETS CONNECT & CHAT:

Snapchat: Mykastauffer

Instagram – http://goo.gl/jmgjc0

Twitter – http://goo.gl/Cu4ccP

Facebook – http://goo.gl/eSjOhw

Google+ – http://goo.gl/FGwC55

Pinterest – http://goo.gl/yDDDpi

?SUBSCRIBE TO OUR FAMILY VLOG CHANNEL:

The Stauffer Life – http://goo.gl/Uzlrgn

If you liked this video please share it with a friend!

Have a video request? leave it in the comments below 🙂

? Mailing Address:

PO Box #1052

715 Shawan Falls Dr

Dublin, OH 43017

? Business Inquiries, Sponsors, Collaboration & just to stop by and say Hi: email listed in “About” section

? Filming Gear I Use:

Sony RX100 IV – https://goo.gl/ZORg22

Canon 70D – http://goo.gl/zBCYiV

Sigma 30mm Lense – http://goo.gl/6ne0zx

Canon EF-S 17-55mm f/2.8 IS USM Lens – https://goo.gl/ljZumq

Rode Video Mic Pro – http://goo.gl/FHUSNL

Light Boxes – http://goo.gl/ffywqn

THANK YOU to every single one of you for being so supportive and watching my channel, it means more than you will ever know! I truly feel like you are part of my family and for this Im so grateful!

FTC Disclaimer: I feel so lucky to call Youtube my job. If I partner with a company I will always disclose it here. Please know my relationship with my viewers is of the utmost importance to me and all opinions and reviews that I share are my own.

*This video is sponsored!*

? ? ?

THANK YOU to every single one of you for being supportive and watching my channel, its appreciated more than you’ll ever know! Like and SUBSCRIBE for more ?

What would your life look like if you didn’t have any credit card payments? If you had a pile of money saved up in the bank? If you owned your stuff instead of it owning you?

You guys—that life is possible!

So, in the latest episode of The Rachel Cruze Show, I’m going to show you how to live debt free. You’ll learn:

• The number one proven method for getting out of debt

• How one couple dug their way out of almost $40,000 in credit card debt

• 10 ways to stay super motivated while getting out of debt

Resources (everything mentioned in this episode):

Show page: https://www.rachelcruze.com/show/how-to-pay-off-your-credit-card-debt-fast

Zander Insurance: http://bit.ly/2Pd6Nss

Churchill: http://bit.ly/2CiIJft

Financial Peace University: https://www.rachelcruze.com/store/product/financial-peace-university-class#in-progress=1

Contentment Journal: https://www.rachelcruze.com/store/product/the-contentment-journal

If you are online looking for these search terms:

– How to get out of debt fast!

– how do i get out of debt

– debt settlement programs

– Do it yourself Debt consolidation

– non profit debt consolidation

– bad credit debt consolidation

– FREE debt consolidation programs

– Debt consolidation information

The take the time to see this video, its free and I’m not selling anything. I did this on my own and it work, you don’t need anyone to do this.

and see.. No links trying to sell you something 🙂

Learn how to get out of debt fast. I show you how to eliminate debt quickly. To request information, go to www.michellemorar.com. Give me a like below if you like the information. Everyone knows how to get into debt, but it is much harder to get out of debt. Watch this informative and entertaining video to see what you can do to get out of debt fast. We take a simple concept immortalized by Dave Ramsey, and I give my insight. You start by finding $200 dollars extra a month. You can get that money in a variety of different ways, but you need to find the extra money. Then you need to attack the smallest debt first, if you want to feel a quick accomplishment. Otherwise, you can choose whichever debt that you attack first then proceed to the next as quickly as possible.

?JENNIFER’S VIDEO ? https://youtu.be/9SoIYxCnaLo

?PLEASE GO SAY HI AND SUBSCRIBE TO HER!!!

?HER BOOKS?

?AT HOME W/ MADAME CHIC: https://amzn.to/2CKZfH8

?POLISH YOUR POISE: https://amzn.to/2NF3vbT

?LESSONS FROM MADAME CHIC: https://amzn.to/2yjhPSO

?JENNIFER’s DEBT FREE + WARDROBE E-COURSES: https://the-daily-connoisseur.teachable.com/

—————————————————————————————————-

In this video I share some extreme money saving tips that helped us to pay off debt and maintain a debt-free lifestyle that brings us so much freedom!

?Want to win with money and clutter? Get my FREE 10 DAY #debtfreeclutterfree cheat sheet ? http://bit.ly/F2FCHEATSHEET ?

?

?KETO MEAL PLAN GUIDE ? http://bit.ly/KETOMADEEASY

?MY EBOOKS ? http://bit.ly/F2FEBOOKS

?MY AMAZON FAVS ? http://bit.ly/MYAMAZONSTORE

?TEACH ESL ONLINE ? http://bit.ly/TeachESLnow

?????????????????????????????????????????????

? Let’s Get Social ? @FREETOFAMILY

? Business Inquires ? freetofamily@gmail.com

?????????????????????????????????????????????

?? ?EARN + SAVE ? ??

? GET $25 TO OPEN A SAVINGS ? https://captl1.co/2Je8oaM

? $10 IBOTTA BONUS ? http://bit.ly/GETIBOTTA (code: bshucjh)

? $10 EBATES BONUS ? http://bit.ly/GETEBATESNOW

? GET 2,000 POINTS w/FETCH REWARDS ? code: DU4KM

? $10 WALMART GROCERY PICKUP ? http://bit.ly/10FREEWALMART

? ECLOTH (clean w/ only water)? https://www.ecloth.com/#5b4425fae8b4a

? GET $40 CREDIT w/AIRBnB ? http://bit.ly/40FREEAIRBNB

?LIFE INSURANCE w/ NO DOCTORS ?http://bit.ly/AFFORDABLELIFE

????????????????????????????????????

? MY YOUTUBE GEAR ?

?Camera: http://amzn.to/2sd0hTj

?Tripod: http://amzn.to/2uiLwQu

?Small Tripod: http://amzn.to/2tnytfm

?MacBook Pro: http://amzn.to/2tUDWyG

?Lacie 1TB Hardrive: http://amzn.to/2wbWw1Z

?Mac Magic Mouse: http://amzn.to/2wbWpTQ

????????????????????????????????????

?WANT TO SEE MORE VIDEOS????

?IKEA “MARKETPLACE”?https://youtu.be/J8EAs5VwPqc

?KITCHEN RENO?https://www.youtube.com/watch?v=00RiEkqzVRI&t=126s

?FRUGAL HAUL?https://www.youtube.com/watch?v=ISMCHoSnNmE&t=5s

?KITCHEN TOUR?https://www.youtube.com/watch?v=WBb0OqMLZe0&t=2s

?LIVING ROOM?https://www.youtube.com/watch?v=hc6umRe-Km0&t=263s

?SAVE MONEY ON GROCERIES?https://www.youtube.com/watch?v=d3n_OgqwyGI&t=25s

?SAVE MONEY FREEZING FOOD? https://www.youtube.com/watch?v=KAXMA6TZLrA&t=1s

?FRUGAL HOUSEHOLD HACKS ?https://www.youtube.com/watch?v=7lHTIipFdzQ&t=1s

?COSTCO HAUL + TIPS?https://www.youtube.com/watch?v=sdSwuuIO_io&t=3s

?COSTCO HAUL + TIPS?https://www.youtube.com/watch?v=hYHmNPFVpa4

????????????????????????????????????

HEY YOU!!! Did ya know that you support our channel by watching, liking and subscribing! Some links may be affiliate and they do NOT cost you extra! Thank you for supporting F2F!!! Xoxo

This video is going to help anyone who has credit card debt and wants to pay them off quickly. Credit cards typically have very high interest rates, so what can you do to lower your interest rate. Watch and find out!

WANT TO SUPPORT THE CHANNEL? HERE’S HOW!

-Buying something on Amazon soon? Support this channel by using our link! https://www.amazon.com/?tag=commoncentsmi-20 It gives the channel a commission without any extra charge! Bookmark it for future uses too!

-BECOME A PATREON SUPPORTER! https://www.patreon.com/bePatron?c=1106118 Even $1 means the world!

-By giving a THUMBS UP and SHARING, you can really help the channel GROW! Doesn’t cost a penny but still makes a difference!

EMAIL: COMMONCENTSMIKE@GMAIL.COM

If you have debts you are Not Alone! According to data taken from The US Census, The Aggregate Revolving Consumer Debt Survey and The Survey of Consumer Finances, 160,000,000 Americans possess credit cards, which is just over half the population of America! More amazingly still, the average credit card debt of $7,219 per household in 2010! So, if you are feeling pinned down by credit card debt, you are certainly not alone! The average indebted American is now poorer than their 1980 counterparts! And this isn’t just an American problem; rather it’s a global problem! Since the end of world war two there has been a consistent push on behalf of the financial sector to push loan facilities, credit cards and all sort of other debts down our throats. We have become a debt based society and even though the 2008 financial meltdown demonstrated the flaws in this system, mouthing really changes as the world economy is based upon debt. While there isn’t much that any of us can individually do for the world economy we can step back and take back control of our finances. In much way the financial reality is like a fence and people are on one side or the other. On one side are the indebted and on the other side are the financially free. While many people repay their debts, within a short space of time they find themselves back in debt all over again. in this book you will be thought not only how to repay your debts but also you shall be thought how to become financially free, for the only way to guarantor your long-term financial wellbeing is to move from debt to wealth and it can be done. We are not talking about get rich quick schemes here; rather we are talking about sensible strategic action, regardless of income, which over time will radically change your financial reality from debtor to investor and from poor to well off! In this book you will learn about: * The five keys to financial freedom * Debt reduction programs * Debt settlement programs * Bankruptcy * Budgeting * Financial planning * How to maintain a budgeting diary * Medium to long -term goal setting * The mind-set reburied to shift from debtor to investor! In this comprehensive book you shall be shown with step by step and practical instructions how to turn your financial situation around. There are no gimmicks, but rather it takes a clear assessment of your financial reality combined with strategic action to turn things around, but it can be done and can be done effectively even if you are an ordinary person earning an ordinary wage! Take the jump today, forget about what everyone else is doing and start to take responsibility of your financial wellbeing back into your own hands!

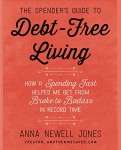

Popular blogger Anna Newell Jones of AndThenWeSaved.com delivers this self-help manifesto that reveals how a “spending fast” will help you get on the road to living debt-free.

In 2009, young photographer Anna Newell Jones was rapidly suffocating under the weight of too much debt. An inveterate “spender,” she was in way over her head, to the tune of almost $24,000. She knew her debt was only going to get worse if she didn’t take action, but she didn’t know where to look for help. On a whim, Anna decided to go on a spending fast—an idea she heard in passing but knew little about. Creating her own method, she learned what worked and what didn’t and wrote about it on her blog, AndThenWeSaved.com. Amazingly, Anna was able to eliminate all $23,605.10 of her debt in only 15 months! She was interviewed in Forbes, Self, Glamour, Good Housekeeping, and the Chicago Tribune.

Anna’s journey inspired people and showed them that they too could change the way they dealt with their own money woes. The Spender’s Guide To Debt-Free Living takes readers through a detailed step-by-step plan on how to do a Spending Fast and get out of debt, including:

Creating a personalized Debt-Free Life Pledge. Understanding where your money is going when you’re in debt, and where it will come from to pay it off. Learning why putting money into a savings account before (or while) paying off debt may not be the best idea for you. Finding additional income sources and generating side gigs. Re-integrating spending into your life once you’re out of debt, so that you stay out of debt.

Filled with do-it-yourself ideas, insight from experts, and tons of motivational tips and real-life practical advice, The Spender’s Guide to Debt-Free Living proves that you don’t have to win the lottery or get a new job to change your life.